The Straits Times’ invitation to readers to send in their queries on MediShield Life saw them raising concerns on who will be included in the new health insurance scheme to what will happen to existing integrated shield plans.

The following are some of the questions received by ST, with the responses provided by the Ministry of Health (MOH):

Pre-existing illness: Who must pay extra?

Singaporeans who developed their health condition after they were insured under MediShield would not have to pay the additional 30% premium loading for the MediShield Life, said MOH, responding to a query from a ST reader on whether the extra 30% under the upcoming MediShield Life be applicable to him, given that he is already using Medisave and MediShield in partial payment of hospital charges relating to his cancer treatment.

Currently, 93 per cent of Singaporeans are covered by MediShield, while the remaining 7 per cent of Singaporeans who are currently uninsured may have to pay the extra 30 per cent if they are found to be in ill health before the compulsory MediShield Life kicks in next year.

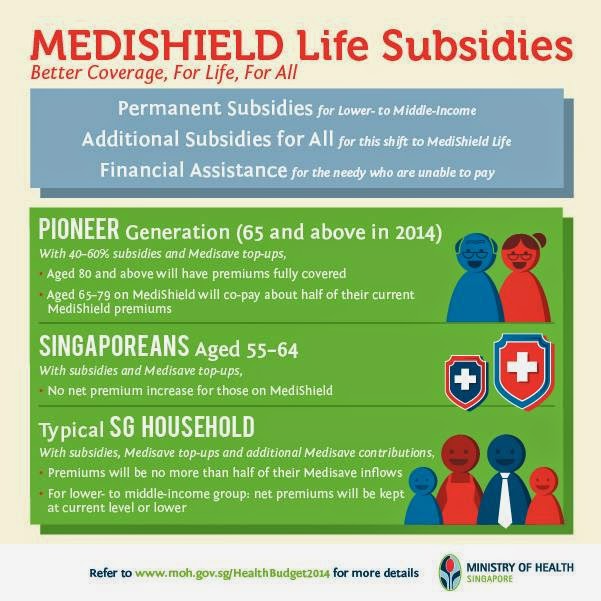

The Government has promised subsidies and Medisave top-ups to help Singaporeans cope with higher premiums.

Members from the Pioneer Generation will also receive further help. The Government will provide MediShield Life premium subsidies starting at 40 per cent for those aged 65 and above this year, namely the pioneer generation. Those above 80 will have their premiums fully paid for by Medisave top-ups and subsidies.

Under MediShield Life, pioneers aged 65 to 79 who are fully insured under MediShield today will pay "about half of their current MediShield premiums after premium subsidies and Medisave top-ups", the MOH said.

Pre-existing illness: Who must pay extra?

Singaporeans who developed their health condition after they were insured under MediShield would not have to pay the additional 30% premium loading for the MediShield Life, said MOH, responding to a query from a ST reader on whether the extra 30% under the upcoming MediShield Life be applicable to him, given that he is already using Medisave and MediShield in partial payment of hospital charges relating to his cancer treatment.

Currently, 93 per cent of Singaporeans are covered by MediShield, while the remaining 7 per cent of Singaporeans who are currently uninsured may have to pay the extra 30 per cent if they are found to be in ill health before the compulsory MediShield Life kicks in next year.

The Government has promised subsidies and Medisave top-ups to help Singaporeans cope with higher premiums.

Members from the Pioneer Generation will also receive further help. The Government will provide MediShield Life premium subsidies starting at 40 per cent for those aged 65 and above this year, namely the pioneer generation. Those above 80 will have their premiums fully paid for by Medisave top-ups and subsidies.

Under MediShield Life, pioneers aged 65 to 79 who are fully insured under MediShield today will pay "about half of their current MediShield premiums after premium subsidies and Medisave top-ups", the MOH said.

Premium subsidies for lower to middle-income families

I am a person with disabilities. I have nothing in my Medisave. Since MediShield Life is for everyone, I presume I am included. But how am I to pay for the premium?

I am a person with disabilities. I have nothing in my Medisave. Since MediShield Life is for everyone, I presume I am included. But how am I to pay for the premium?

The Government will put in place a range of additional support measures to help Singaporeans, especially those on lower to middle incomes and the elderly. For instance, there will be premium subsidies for lower- to middle-income households, which will cover up to two-thirds of the population.

These premium subsidies will be a permanent feature of MediShield Life and will not be phased out after a few years. For those who need help with their premiums even after the subsidies, the Government will provide additional premium financial assistance.

The Ministry of Health will finalise the subsidy measures and provide more details after the Committee has submitted its final report and recommendations.

Singaporeans working and living overseas – do they need to have MediShield Life? What if they have very little in Medisave?

In line with the principle of universal coverage, the Committee has recommended that all Singaporeans should be covered under MediShield Life for life.

Singaporeans working and living overseas will benefit from the MediShield Life protection for life at any point that they choose to return to Singapore for medical treatment.

Singaporeans working and living overseas will benefit from the MediShield Life protection for life at any point that they choose to return to Singapore for medical treatment.

Why do people who are fully covered by their companies need to have MediShield Life – isn't it a waste of money for nothing?

All Singaporeans have to join the scheme and do their part. This includes those who receive benefits from their employer. The Committee encourages employers to recognise the mandatory universal nature of MediShield Life and study how best to support their employees’ participation in the national insurance scheme.

MediShield Life will ensure that all Singaporeans will be protected against large hospital bills regardless of how their life and health circumstances change over time, even during unemployment, or if the medical benefits provided by the employer is not portable.

Nonetheless, the Committee is studying the issue of Employer Medical Benefits and how they interact with MediShield Life and will share their observations when ready.

Will Singaporeans who are currently under the pension scheme still be included in MediShield Life?

MOH clarified that pensioners would not lose out, although MediShield Life will apply to all Singaporeans and permanent residents, including those who are currently receiving employer benefits like pensions. The Government has indicated it will study the issue carefully together with the unions, and ensure that pensioners will not be adversely affected with the introduction of MediShield Life.

MOH clarified that pensioners would not lose out, although MediShield Life will apply to all Singaporeans and permanent residents, including those who are currently receiving employer benefits like pensions. The Government has indicated it will study the issue carefully together with the unions, and ensure that pensioners will not be adversely affected with the introduction of MediShield Life.

RESPONSES FROM HEALTH MINISTRY

Readers query impact of MediShield Life

Questions range from who it covers to fate of integrated shield plans

By Linette Lai, The Straits Times, 12 Jun 2014

Questions range from who it covers to fate of integrated shield plans

By Linette Lai, The Straits Times, 12 Jun 2014

CONCERNS about MediShield Life range from who will be included in it, to what will happen to existing integrated shield plans, according to readers responding to The Straits Times' invitation to send in their queries about the new health insurance scheme.

The most common question was raised by retired civil servants already on pension schemes.

They asked how MediShield Life would benefit them, since the majority of their health-care bills are already taken care of.

The Government used to pay out pensions to civil servants that included generous health benefits but stopped placing junior civil servants on the scheme in 1973. Last year, some top civil servants also had their pension schemes replaced by different plans.

Mr Raoul Sequeira, for instance, who retired from the Singapore Armed Forces in 1995, is now under a pension scheme that gives him and his wife free lifetime medical coverage for most conditions. It also subsidises 80 per cent of ward charges if either of them is hospitalised.

He is currently covered by MediShield but has hardly ever needed to use it. And when MediShield Life kicks in next year, his premiums will probably go up because of the improved benefits and universal coverage.

"I presume it's going to be affordable but why should I have to pay for something that I don't need," asked the 67-year-old.

"I don't think that should be the case," he added.

Another pensioner asked if the Government would pay for the increase in their premiums, and whether they would be compensated.

Responding to the questions, the Health Ministry said pensioners would not lose out, although MediShield Life will apply to all Singaporeans and permanent residents, including those who are currently receiving employer benefits like pensions. "The Government has indicated it will study the issue carefully together with the unions, and ensure that pensioners will not be adversely affected with the introduction of MediShield Life," said a spokesman for the ministry. More details will be announced at a later date.

Pre-existing illness: Who must pay extra?

It won't apply to those who got sick after being covered by MediShield

By Kash Cheong, The Straits Times, 14 Jun 2014

It won't apply to those who got sick after being covered by MediShield

By Kash Cheong, The Straits Times, 14 Jun 2014

PART-TIME data entry worker Yuen Ho Wah was covered by MediShield when he found out he had colon cancer four years ago.

Along with Medisave, it has paid "most" of the $100,000 his treatment has cost since.

So when the MediShield Life Review Committee recommended recently that people with pre-existing conditions pay higher premiums to reflect their higher risks - namely an additional 30 per cent for ten years - Mr Yuen was worried.

"Will the extra 30 per cent under the upcoming MediShield Life be applicable to me?" asked the 66-year-old in an e-mail to The Straits Times. "I am already covered by MediShield and I hope I won't be paying much more extra in the new scheme."

However, the Ministry of Health (MOH) has assured people like him that, under the plans, they would not need to fork out an additional 30 per cent in premiums when MediShield Life starts late next year.

If your health condition developed only after you were insured under MediShield, the additional premium loading of 30 per cent would not apply, the MOH said, adding the extra amount would apply only to those "who are already in ill health before the start of their insurance coverage under MediShield or MediShield Life".

Currently, 93 per cent of Singaporeans are covered by MediShield.

The uninsured 7 per cent includes over-65s, low-income or jobless Singaporeans who cannot afford to pay the premiums and people who opted out because they have private insurance or are covered by their employers.

If these people are found to be in ill health before the compulsory MediShield Life kicks in next year, they would have to pay the extra 30 per cent.

The Government has promised subsidies and Medisave top-ups to help Singaporeans cope with higher premiums.

As he is part of the pioneer generation, Mr Yuen will receive further help. The Government will provide MediShield Life premium subsidies starting at 40 per cent for those aged 65 and above this year, namely the pioneer generation.

Those above 80 will have their premiums fully paid for by Medisave top-ups and subsidies.

Under MediShield Life, pioneers aged 65 to 79 who are fully insured under MediShield today will pay "about half of their current MediShield premiums after premium subsidies and Medisave top-ups", the MOH said.

"It's a relief to know that I don't have to pay the extra 30 per cent and pioneers like me will be getting more help," said Mr Yuen, whose condition is improving. "It gives us greater assurance in our retirement years."

Questions to ask about MediShield Life

Will premiums be affordable? Should you go private? What about co-payment?

By Mok Fei Fei, The Sunday Times, 15 Jun 2014

Will premiums be affordable? Should you go private? What about co-payment?

By Mok Fei Fei, The Sunday Times, 15 Jun 2014

What the insurers say

Proposals unveiled recently by a committee tasked to look at enhancing the national health insurance scheme MediShield contained much good news.

MediShield Life - enhancements to the MediShield scheme - would offer higher payouts and, therefore, lower out-of-pocket expenses for CPF members.

But there are concerns that the increase in premiums, the details of which which have yet to be released, may be substantial for some. Throw some insurance terms such as "deductible" and "co-insurance" into the picture and it's no wonder many are left with fuzzy ideas of what the reforms are all about.

A tongue-in-cheek way to remember MediShield Life is to think of it as a Look Into Future Expenses, specifically large hospital bills.

The Sunday Times checks out how the new plans could affect you.

Basic plan

First, MediShield Life will ensure that everyone, even those with pre-existing conditions previously not covered under MediShield, will be insured.

Senior citizens can also heave a sigh of relief as all of them - a group more likely to need the insurance - will be covered. Currently, MediShield's coverage is extended only to those up to 92 years of age.

Other MediShield Life recommendations include the removal of the lifetime claim limit of $300,000, increasing the policy year claim limit by 40 per cent from $70,000 to $100,000, and higher claim limits for expenses like outpatient cancer treatments.

Under the proposals, there would also be lower co-insurance rates from between 10 per cent and 20 per cent, to between 3 per cent and 10 per cent.

"Co-insurance" is the amount of money in a large hospitalisation bill that you have to bear above the deductible.

A "deductible", meanwhile, is the initial sum that you have to pay for claims made in a policy year, before you receive a MediShield payout.

The deductible ranges from $1,500 to $3,000 and is put in place by the authorities to sieve out small claims, since the aim of MediShield is to help pay for large hospitalisation bills.

MediShield Life will continue to cover only Class B2 and C public hospital bills.

People who wish to stay in private hospitals or Class A and B1 wards in public hospitals should note that MediShield Life will cover only the amount it would for a B2 patient. It will not be able to pay the bulk of your bill, so you would need additional coverage on top of MediShield Life, known as Integrated Shield Plans (IPs).

Integrated Shield Plans

On top of the basic MediShield scheme, there are currently five insurers - AIA, Aviva, Great Eastern, NTUC Income and Prudential - which provide Medisave-approved IPs. About two in three Singaporeans are on Integrated Shield Plans.

This means you can use your Medisave savings to pay for the IPs, which are combined with basic MediShield to form a single integrated plan.

IPs provide benefits above and beyond what the basic MediShield scheme provide.

For instance, some IPs already offer lifetime coverage, coverage for certain pre-existing conditions, overseas medical treatments and the like.

With the enhanced MediShield Life scheme, there may be some overlaps with the IPs.

The Sunday Times understands that the MediShield Life Review Committee is in talks with the five insurers, reviewing the issues related to IPs, and will share its recommendations soon.

Mr Sumit Narayanan, partner for advisory services at consultancy firm EY in Singapore, said: "With the recent MediShield Life proposals, some uncertainty in the near term is to be expected as the proposals are being finalised."

He added: "This is a good opportunity for IP providers to launch more innovative products to cater to the different needs of the population."

Mr Andrew Taggart, PwC's South-east Asian insurance consulting leader, said: "The risk for IP providers is that their customers get confused by the new proposals in transition, so clearly articulating the impacts and reminding customers of the value of the plans will be an important activity for providers in the short term."

IP providers will also have to make sure they raise their game, not just their premiums, to ensure the enhanced MediShield Life scheme does not erode their competitiveness.

"The IP providers will need to work through the product and pricing implications of the changes particularly around pre-existing conditions to decide if they will cover them and if so at what price," said PwC consulting partner and actuary Steven Lim.

Reactions from the IP providers to the changes being made to MediShield are generally supportive.

AIA Singapore chief marketing officer Ho Lee Yen said: "AIA Singapore is working very closely with the authorities and will continue to review our policies to help ensure that insurance will remain easily accessible and that our customers' needs are addressed."

Industry players also stressed that the IPs are not competing against the basic plan.

NTUC Income chief executive Ken Ng said: "MediShield Life and Integrated Shield Plans will continue to serve Singaporeans in complementary ways, catering to different needs."

Mr Daniel Lum, director of product and marketing at Aviva Singapore, said premium rates for IPs change periodically as they are highly dependent on factors such as past claims experience and medical inflation. "These premium adjustments ensure that the premiums collected are sufficient to cover the amount of claims paid out," he said.

Great Eastern chief product officer Lee Swee Kiang said: "While some may choose not to continue with their IP, we do not expect a large percentage to do so and we will be proactively explaining and educating our policyholders on the importance of retaining their IP."

Prudential Singapore chief marketing officer David Ng said: "We are confident that even with the changes that are eventually made to MediShield, our policyholders will continue to enjoy the additional insurance protection that they are covered for."

What next?

All eyes are now on that critical premium number. It's been reported that the final submission from the MediShield Life Review Committee will be handed to the Government by the end of this month.

A debate on the proposed landmark changes will then be held.

Once that information is available, those with basic MediShield as well as the integrated plans can then sit down and work out their sums.

Ask pertinent questions such as whether you need to stay in a private ward, whether you can afford the premiums not just now, but in future.

If your company also provides health insurance coverage for you, check how best that complements the MediShield Life plan and then see if you need to upgrade to an integrated plan.

Remember though, that not every company-sponsored insurance plan has portable health benefits, so if you leave that firm, you may lose those benefits.

You would then have to start a new plan at an older age and possibly in poorer health, which will in turn mean higher premiums for your new health plan.

Policyholders want health-care providers and insurers to control any ballooning of medical costs, by controlling costs at the treatment and premium levels. The likely higher premiums will come on top of premiums which were already raised last year by IP providers, owing to the enhanced MediShield package that gave higher annual payouts, among other things.

However, Dr Khoo Kah Siang, president of the Life Insurance Association, told The Sunday Times: "There will be minimal impact on the IP component of premiums.

"For IP benefits, the premium rates are subject to change as per normal, taking into account claims experience, future consumption trend and medical inflation rate.

"IP insurers will continue to monitor and manage these factors, to ensure that their plans remain competitive and affordable."

Still, do compare across insurers and figure out which plan best suits your needs. It is after all, a matter of life and death.

Related